Funding and Financing Options for Resilience Investments

Nuin-Tara Key, Carolyn Kousky, and Tai Michaels

This is the first installment in a blog series from CA FWD and Insurance for Good. Our two organizations have partnered to develop an actionable guidebook that outlines replicable funding and financing strategies for risk reduction and resilience. This blog summarizes the key themes coming from recent discussions by the expert workgroup convened through the partnership.

The costs of climate change are rising rapidly. A recent research study found that over the next 25 years, climate change will drive a global reduction in income of at least 20% and it will likely be far higher. (Notably, the authors find these damages already outweigh the costs of emissions reductions by at least six times.) Another study finds extreme weather is already costing the world $16 million per hour. Over the last decade, extreme weather has cost the economy $2 trillion. These impacts hurt our communities and residents, not only in the form of staggering disaster impacts, but also in higher daily living costs as increases in utility bills, insurance premiums, and other climate-driven inflation hits pocketbooks.

To manage these growing costs, communities need greater investments in loss reduction and climate adaptation. This includes investments from the household scale to the level of the community and touches all of our built environment and infrastructure. Despite growing recognition of the necessity of climate adaptation, funding and financing are key barriers to crucial action. For example, a survey of Californian cities found that insufficient funding was the most frequently cited reason for being unable to implement adaptation projects. This becomes even more critical as federal funding for adaptation has been dramatically curtailed under the current administration.

Funding vs. Financing

Funding and financing, while often used interchangeably, are two distinct needs. Funding is the actual dollars to pay for an investment. Financing is any approach that allows for a large sum of money to be used at one moment but paid for over time. For big projects, financing is often needed, usually through a debt instrument, like bonds, but all financing also needs a funding source—for example, local revenue used to pay back the debt over time.

For resilience investments—like most other investments—there are essentially five options for securing the needed dollars for the investment:

Use your current budget to pay for the project as it is built or the investments as they are undertaken.

Save money over time and, once enough has been set aside in reserves, invest in the resilience measure(s).

Pay later by using debt financing to secure funds for the investment up-front and then pay back the debt over time.

Pay first by using insurance-like financing tools that provide funding at a particular moment after premiums have been paid.

Have someone else pay, such as grants from another level of government or philanthropy.

Challenges for Resilience Investments

These options can be more challenging for resilience and climate adaptation for many reasons. First, projected future losses are not tracked on most balance sheets. This makes it difficult to turn future losses into a cash flow to finance investments. Second, and relatedly, when it comes to climate impacts, many of our investments are simply to make future impacts less costly—making something less bad rarely leads to cash flows because it’s not recognized as savings. Third, many markets are not fully pricing climate risks. This limits saving from insurance or lending, for example, in helping produce cash flows for investments. And finally, many benefits are diffuse and accrue to many members of a community—such public goods are typically provided by government but many U.S. local and state governments face constrained budgets and competing priorities at a time, when federal funding for risk mitigation projects has been halted or reduced.

Where to Start?

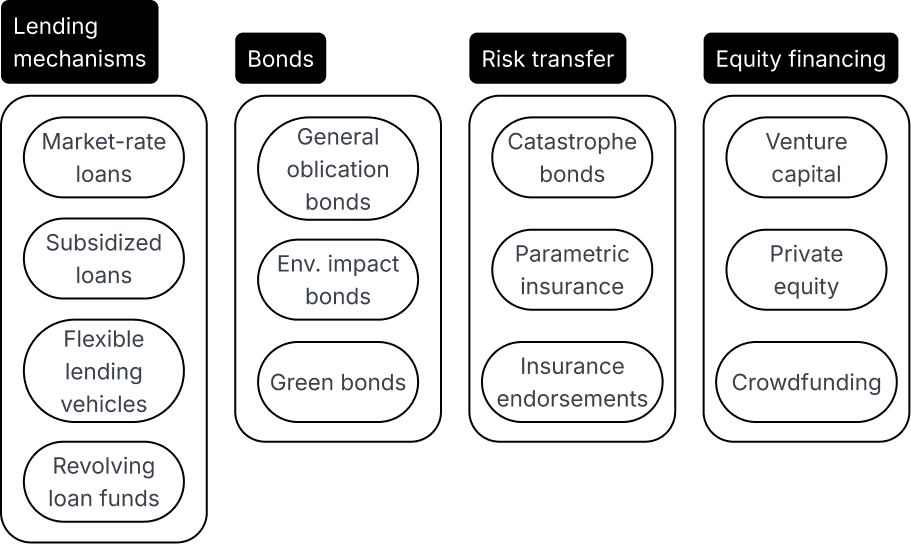

There are many sources of both funding and financing for these investments. Figures 1 and 2 summarize the range of both funding and financing options available for these investments. In future posts in this series, we will be exploring these options in more detail and which are best fit for which purposes and contexts. Not all will work in every locality or for every risk, and certain instruments can also be fit together to create the most effective and viable model for a given investment.

Figure 1. Funding Options

Figure 2. Financing Options

This blog is cross-posted at CA FWD.