Do California Insurers Reward Wildfire Resilience?

Carolyn Kousky and Xuesong You

In 2022, California implemented regulations requiring homeowners insurers to adopt premium discounts for policyholders who take steps to lower the risk of a wildfire burning their home. In this essay, we examine how California insurers have responded to these new regulations and summarize the premium reductions currently available in the California market. If homeowners adopt both the maximum home hardening upgrades and defensible space, the greatest premium discount they will receive varies from only a few percent to over 50 percent depending on the insurer and the loss reduction standards adopted.

Making Homes Safer from Wildfire

Wildfire risk in California has been growing as a result of a confluence of factors. Climate change is increasing the frequency of hot and dry conditions that exacerbate wildfire behavior. A warming planet has also brought drought and pest infestations to California’s forests, causing millions of trees to die, which then become easy fuel for a fire. The number of structures in areas prone to wildfire has grown and many of those have not been built to high levels of wildfire resistance. A history of fire suppression has led to fuel buildup in some of the state’s forests, causing more catastrophic fires than there would be otherwise. All of these are driving up wildfire risk in the state.

As several fires have demonstrated, including the recent blazes in Los Angeles, it is not just wildland fires that are a risk to California, but also urban conflagrations, which can occur when those wildfires spread into developed areas. In urban fires, buildings become the fuel that allows fire to spread from structure-to-structure. While the dangerous combination of high winds and very dry conditions enables these urban fires, how we build can make a difference. This includes making homes more wildfire-resistant, reducing flammable materials near the home, and ensuring adequate separation between structures. Creating fuel breaks in the community and improving the management of surrounding natural lands can also lower fire risk.

Wildfire and building science has identified measures that help make homes more fire-resistant. This includes protecting the home against embers, radiant heat, and flames through upgrades such as installing flame- or ember-resistant vents, cleaning gutters, installing a Class A roof, using multi-pane windows, and ensuring noncombustible clearance on exterior walls, among others. Many of these improvements are captured in California’s Chapter 7a building code, one of the strongest fire codes in the country (becoming California Wildland-Urban Interface Code (CAWUIC) Part 7 in 2026). Adopted in 2008, the code applies only to new construction in certain designated areas. So, while critical, many existing structures across the state still need retrofitting. There are also some areas at greater risk of urban fires, including part of the Eaton fire footprint, where the code should arguably apply but does not.

Beyond the structure itself, the so-called “zone zero” of zero to five feet from the home should also be clear of combustible materials. This includes removing brush, mulch, or firewood piles, for example, and also ensuring fencing next to the house is noncombustible. Research examining surviving homes after past wildfires verifies the huge value of these changes: not only does it help make homes less likely to burn, but it also provides protection to neighboring homes.

Community layout also matters. Homes can ignite their neighbors through embers, flame, or radiant heat. A minimum of 30 feet between structures is recommended to limit spread from one home to another. In addition, creating buffers around clusters of hardened homes and ensuring easy road access for firefighters can possibly slow spread or increase the effectiveness of firefighting defense forces.

The greatest fire reduction is achieved when all these measures are done together. Recent studies examining past fire losses indicate that combining home hardening with the creation of defensible space has the potential to dramatically reduce losses. The Insurance Institute of Business and Home Safety (IBHS) has designed the integrated Wildfire Prepared Home (WPH) Base and WPH Plus standard, which unite all these measures for maximum protection. WPH covers core features such as the roof and vents, as well as enclosing lower-level decks where embers might land, establishing the 0-5 foot non-combustible zone, and defensible space in the yard. WPH+ adds additional requirements that focus on areas where home ignition or spread is most likely to occur, such as upgrading windows and doors to withstand heat-induced shattering, switching to non-combustible materials for decks, and moving adjacent structures and connected fencing away from the main building. Additionally, IBHS has announced a Wildfire Prepared Neighborhood standard that also integrates community-level measures. The IBHS standards are the most stringent and comprehensive, although it may be more difficult and expensive to achieve in already built homes and communities.

Insurance Incentives for Loss Reduction

Insurance prices should reflect risk. When measures are adopted that lower wildfire risk, then, this should be reflected in insurance market outcomes in terms of lower prices or greater availability of coverage. There have been consumer concerns, however, that even when investments in safety are made, they have not been showing up in the insurance market. Why does this matter?

Mitigation discounts build consumer trust in the insurance market. It demonstrates that insurance pricing takes into account the actual risk at a property, as well as any benefits associated with mitigation investments made on the property, and that insurers will share those benefits with their policyholders. This increases perceptions of fairness.

Discounts for loss reduction also correct market failures. When a homeowner invests in risk mitigation that effectively reduces potential losses, they lower not only their own risk of experiencing a catastrophic fire but also the insurer's overall exposure. Without mitigation discounts, homeowners bear the full cost of these investments while the insurers reap much of the financial benefit of reduced losses. Beyond this being perceived as unfair by consumers, it also is a form of market failure, where homeowners have less incentive to invest in mitigation because the full benefit is not reflected in their premiums. Insurance discounts for mitigation allow homeowners to capture some of the economic value, thereby aligning financial incentives – homeowners are rewarded with lower premiums for their individual investments in risk reduction.

Transparent mitigation discounts help convey information about clear actions customers can take. Beyond aligning incentives, mitigation discounts also generate valuable information by simplifying complex engineering guidance into clear price signals that households can easily understand. When insurers set discounts appropriately to reflect the value of each mitigation measure, households can quickly learn about the effectiveness of these investments with reduced information costs. But this value only materializes if the discounts are accompanied by clear and transparent communication.

Individual mitigation generates collective benefits. Finally, there are two types of spillover effects as homeowners engage in mitigation. When one property owner reduces risk it lowers risk for the neighbors, as well. Also, when neighbors take actions to reduce risk, others often follow suit. The increased demand for fire-resistant building materials, defensible space services, or/and certified inspectors can then help lower costs over time through economies of scale and create positive feedback loops encouraging even greater loss reduction and further improved insurance market outcomes.

California’s Recent Regulations

Since wildfire mitigation discounts were not being widely offered voluntarily by insurers, the California Department of Insurance adopted a new regulation in the fall of 2022 referred to as Safer from Wildfire. The regulation requires property insurers in California that offer any price variation based on wildfire risk to also adjust their rates to account for investments in improving the wildfire resilience of homes (CA Code of Regulation Section 2644.9). The California Department of Insurance created a list of a dozen wildfire risk reduction measures that insurers had to consider in new rate filings by spring 2023.

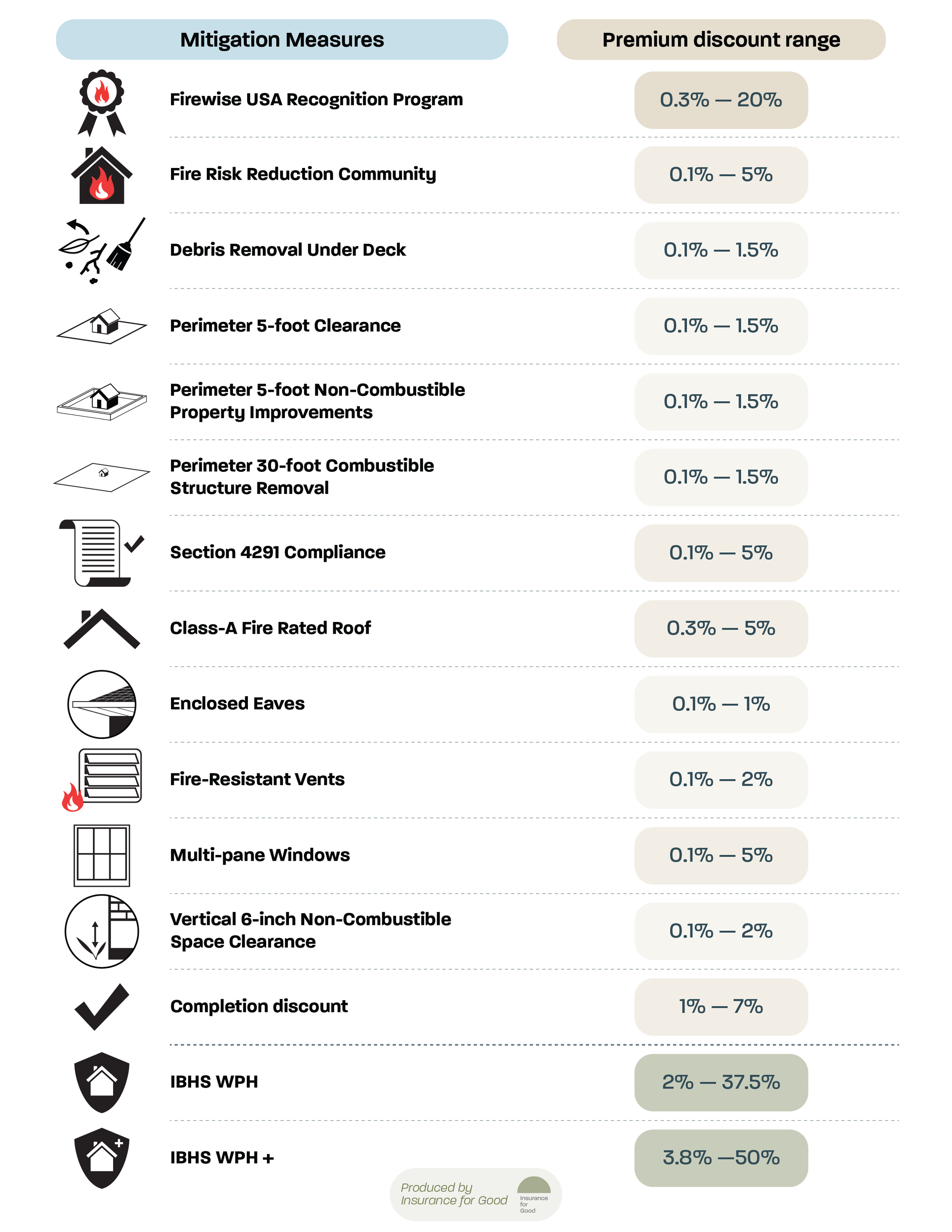

This list, as detailed in Table 1, includes two community-level designations, five defensible space-related measures, and five home hardening-related measures. The two community measures are Firewise USA, a voluntary program that provides a framework for communities to reduce risk, and the state’s list of Fire Risk Reduction Communities, which have met best practices for wildfire planning. Of note, since the IBHS Wildfire Prepared Home program launched that same year, it is not on the required list from the Department of Insurance, although some insurers are offering discounts for it voluntarily.

The regulation did not, though, mandate what the discounts for each mitigation measure had to be – only that insurers must offer something. That said, insurers have to provide justification for the discounts in their rate filing. As loss data and evidence on various measures continues to be collected, the discounts should likewise evolve. In addition, while insurers are required to take these twelve specific measures into account, they are not prohibited from considering others such as fuel management or firefighter access. Insurers have the option to incorporate these additional factors by either integrating them into the wildfire risk score used for rate-setting or by providing separate credits for them.

Table 1: Wildfire Mitigation Measures California Insurers Must Consider for Rate Setting

In addition, insurance companies were required to notify policyholders about the new regulation. The communication to the policyholder had to include details on the risk classifications and discounts, explain how the current policyholder was being evaluated, and outline what mitigation measures the policyholder could adopt to obtain greater savings.

Wildfire Mitigation Discounts in the Market

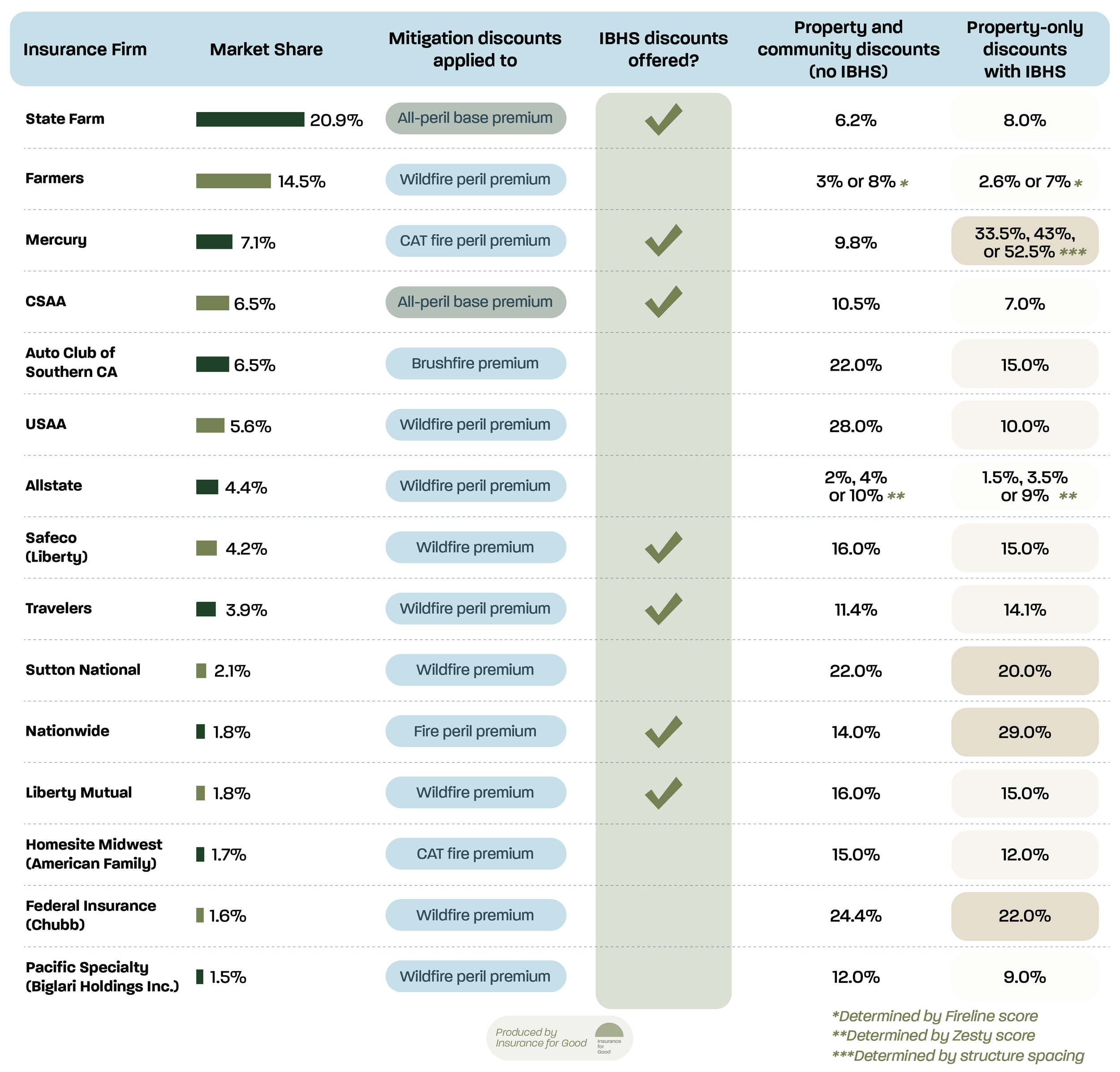

To gain a better understanding of the wildfire mitigation discounts available in the market, we reviewed the current rate filings as of January, 2026 for the top 15 California insurance companies, which together account for 83% of the market share according to direct premiums written for homeowners business in 2024. Note that insurers could have rate filings under review and will submit new ones over time – this is thus a current snapshot of the market. The appendix table at the end of the post shows all the discounts for each of the mandated 12 mitigation measures by these insurance companies (listed in order of market share), as well as the discounts offered for optional measures such as IBHS Wildfire Prepared Home. In addition, some insurers offer a “completion discount,” which is an extra premium reduction for homeowners that have undertaken some or all the mandated measures. Table 2 summarizes this information and shows the range of discounts offered for various mitigation measures across these insurers. (Note that the CA FAIR plan also provides discounts but they are not included in our analysis. You can read about those here.)

Table 2: The Range of Wildfire Mitigation Discounts Offered by the Top 15 Insurers

Before we dive into the main findings, there are three important notes about the numbers. First, this table reflects pricing, not underwriting – it says nothing about whether these insurers are offering more or fewer policies in high-wildfire risk areas. (The California Department of Insurance has another approach – the Sustainable Insurance Strategy – to increase greater writing of policies in wildfire-prone areas.)

Second, note that the percentage numbers apply to different base premiums, the fundamental starting price of a policy. Different insurers will charge different premiums for the same property, so the percentage shown will not translate to the same dollar discount. Also, note that some insurers apply their discounts only to the wildfire portion of the premium, while others apply them to the entire premium. A percentage applied to just the wildfire portion will have a lower impact in absolute dollars for the policyholder than one applied to the entire premium. This is noted in the table: State Farm and CSAA are the two insurers that apply percentages to the entire premium and the others apply just to the wildfire portion of the premium.

Finally, in most cases, the mitigation measures do not affect the “Wildfire Risk Score” used by some California insurers to determine rates; instead, they are applied as a discount factor. However, in some instances, these measures can directly change the “Wildfire Risk Score,” resulting in a change in the premium through both the score and the discount factor.

What did we find?

Discounts vary greatly across insurers. The same mitigation measure can be treated quite differently by different insurers. For example, the discount given for living in a Firewise Community ranges from less than 1% to 20% (both applied to the wildfire portion of the premium). Having a Class A roof can yield discounts from less than 1% to 5%. Some insurers offer no discounts for IBHS WPH(+) properties, and among those that do, properties that meet the IBHS WPH+ standard can receive discounts ranging from less than 4% to 50%. This variation is somewhat surprising and suggests insurer confidence in the evidence base around the effectiveness of different measures may vary considerably, as well as their assessment of consumer demand to maintain a policy with an insurer that rewards wildfire mitigation. Given the variation in discounts, consumers who have invested in wildfire risk reduction should shop insurers, especially those with an IBHS WPH or WPH+ home since not all carriers are offering sizable premium savings for that level of certified investment in loss reduction.

Mitigation measures are not equal. Wildfire and building science indicate that all mitigation measures are not equal in terms of loss reduction and this is clearly reflected in insurer discounts: some measures are given larger premium reductions than others. In particular, having a Class A roof stands out as widely recognized as an important upgrade, with six insurers offering the highest discounts for this as compared to other property-level measures. Since most homeowners in California already have a Class A roof, this discount should be widespread. Still, a number of insurers simply offer the same discount for each individual measure, regardless of their varying potential impacts on losses. This is likely due to a lack of data from historical experience to accurately evaluate and model the loss impact associated with one-off adoption of individual mitigation features. Indeed, a few insurers have noted in their filings that they do not have sufficient and credible wildfire-specific claims data, along with the necessary details on required mitigation measures, to inform the discounts they establish.

A comprehensive approach to mitigation matters. Many wildfire experts note that it is important to do all the wildfire risk reduction measures as a complete package. When individual mitigation measures are taken in isolation, their effectiveness in reducing losses can be limited. However, when some or all of these measures are combined, their effects can be much larger. This understanding is also reflected in the discounts. Many insurers offer only small price reductions – often around half a percent for each individual measure alone. When done together, however, the premium reductions combine and four insurers – Farmers, Allstate, Travelers, and Sutton National – also offer an additional “completion discount.” Mercury refers to their version of completion discounts as “Mercury Wildfire Mitigation (Essential, Enhanced, or Elite)” discounts. While Auto Club Southern California does not offer a standalone “completion discount,” it provides a tiered structure that rewards substantial completion: Policyholders who complete up to six property-level measures will receive a 1% increase in their discount for each additional measure completed; for those who complete seven or more total measures, the discount increase accelerates to 2-3% for each measure completed beyond the sixth.

To further incentivize a comprehensive approach to mitigation efforts, seven insurers – State Farm, Mercury, CSAA, Travelers, Safeco, Nationwide, and Liberty Mutual – also offer discounts for IBHS certification, with some providing sizable savings. The IBHS WPH and WHP+ standards are complete packages of many measures together. Specifically, IBHS WPH includes property-level measures shown in Table 1 of 3, 4, 5, 8, 10, and 12 and IBHS WPH+ includes all those, as well as 6, 9, and 11. When policyholders qualify for both individual and IBHS discounts, four of the seven insurers that reward IBHS certification – State Farm, Mercury, CSAA, and Travelers – provide premium savings in the form of an IBHS-specific “completion discount,” i.e., an additional discount on top of the individual discounts for measures taken alone. The remaining three insurers only provide the IBHS discount as the maximum available discount, although this IBHS discount is typically greater than the sum of these individual discounts alone.

Note that the IBHS discounts from Mercury depend upon home spacing, which has been shown to influence how likely a home is to catch fire from its neighbors. The maximum IBHS discounts for WPH (37.5%) and WPH+ (50%) are for homes at least 30 feet from each other. At less than 10 feet separation, those discounts drop to 22.5% for WPH and 30% for WPH+. The Mercury version of completion discounts (for homes that do not have IBHS designations), what they refer to as “Mercury Wildfire Mitigation (Essential, Enhanced, or Elite)” also varies by home separation. These discounts are just slightly less than those given for IBHS certifications.

The way firms combine discounts, however, varies, making the total potential discounts for completing multiple mitigation efforts less straightforward. Some insurers, such as Mercury, USAA, Travelers, and Federal Insurance, multiply discounts (rather than adding them). For example, if a Federal Insurance customer installed a Class-A roof (5% discount) and multi-pane windows (5% discount), Federal Insurance calculates the total discount as 1 - (1-5%)*(1-5%)=9.75% (instead of 5% + 5% = 10%). The difference grows larger when you do the multiplications for all 12 measures. When a home is located in a community recognized as both a Firewise USA site in good standing and a Fire Risk Reduction Community, some insurers, such as Auto Club Southern California, Sutton National, and Pacific Specialty, impose a maximum cap that is lower than the combined community discounts.

To facilitate comparison, we calculate the total possible discounts that policyholders should expect from the top 15 insurance companies. Table 3 lists these firms, whether or not they offer an IBHS discount, and outlines the premium discount policyholders should expect for two combinations of mitigation measures: (1) completing all 12 mandated property-level and community-level measures/designations from Table 1 (shown in column 5 of Table 3), and (2) completing all 10 property-level measures, as well as IBHS WPH+ certification (for those insurers not offering IBHS discounts, it is just the discount for completing all the property-level measures) (shown in column 6 of Table 3). Again, we observe wide variation among insurers. In Column 5 of Table 3, the total potential discounts for completing all 12 mitigation measures (without obtaining IBHS certifications) range from 3% to 28%. In Column 6, having a home that completes all 10 property-level measures and is IBHS WHP+ certified can yield potential discounts of 2.6% to 52.5% across different insurers.

Table 3: Select Wildfire Mitigation Discounts by Firm

Verification processes differ. While not shown in the table, the methods used by insurers to verify mitigation efforts also vary, as noted in their filings. For the property-level mitigation measures, some insurers require certified inspections conducted by approved inspectors or from an independent, third-party organization like IBHS, while others only require self-attestation or customer-provided photos or documentation. It is generally easier and less costly on the policyholder if they can self-attest or provide photos. That said, if insurers are going to give substantial discounts, they will want to be certain the mitigation measures have been properly implemented.

Absolute discounts will depend on risk levels. Also, note that the underlying risk may still lead to higher premiums in the riskiest locations, but the dollar value of mitigation discounts will also be greater in those areas. For example, consider two hypothetical homes, Home A and Home B, both insured with Liberty Mutual, in a Los Angeles community recognized as a Firewise USA site in good standing and a Fire Risk Reduction Community. Home A is at a high risk of wildfire and has an initial premium (without mitigation) of $8,302, with $4,509 attributed to wildfire peril. In contrast, Home B has a low wildfire risk with an initial premium (without mitigation) of $2,339, and just $30 attributed to wildfire peril. If both homes are built to the WPH+ standard, they could each qualify for a discount of 21% off the wildfire portion of their premiums. The homeowner of Home A would save $4,509 * 21% = $947, while the owner of Home B would save $30 * 21% = $6. The absolute discount for Home A is much larger, but so is their final premium due to the higher risk associated with their location.

Considerations for the Future of Insurability in California

Reflection of mitigation investments in insurance pricing not only increases perceptions of fairness in insurance markets but also is an information signal and financial incentive to drive much needed investments in risk reduction measures. The recent regulation by the CA Department of Insurance has been successful in requiring insurers in the state to incorporate wildfire mitigation measures into their pricing, although the magnitude of these pricing reductions varies considerably, suggesting lack of agreement across the industry on the direct relationship between some individual measures and lower claims payments. As data evolves on the effectiveness of different measures, the offered mitigation discounts should also adjust.

It is clear from wildfire science that the most risk reduction is achieved when a full suite of home hardening and defensible space measures are taken together. Insurer premium discounts also reflect this reality, with the largest savings being awarded to homes that have undertaken all the measures or have complied with the IBHS standard. Indeed, the highest discounts are for homes that achieve the IBHS WPH+ standard, although substantial reductions can also be achieved for homes that adopt all the measures in the list from the Department of Insurance. While the premium discounts are unlikely to cover the full costs of wildfire home hardening retrofits, they do help promote longer-term insurability and, importantly, lower future losses–including uninsured losses, such as irreplaceable personal items.

The way the discounts are calculated, what measures are rewarded, and how they can be combined is different for every insurer. This is likely to create consumer confusion and makes messaging around mitigation and insurance more challenging. Indeed, it is unclear how much transparency there is for consumers around these discounts. While insurers were required to notify policyholders, consumers often disregarded mailings. In addition, most consumers do not often re-shop their insurance with an independent agent. The variation in discounts offered suggests it could be highly advantageous to a homeowner who had invested in home hardening, particularly doing many of the measures together or achieving either of the IBHS certifications, to then contact an independent agent (one not tied to only one insurer) or multiple captive insurance agents (those working for only one firm) to get multiple quotes and compare which firm would offer them the best price.

The discounts currently offered on the market, however, are provided against a backdrop of ongoing insurer concern about rate adequacy in the state. The Department of Insurance has undertaken several other related reforms to address these concerns and encourage more insurers to return to California. This includes their Sustainable Insurance Strategy, which allows for the use of wildfire catastrophe models in rate-setting and also allows insurers to account for reinsurance costs. Both also come with requirements to expand coverage availability in higher-risk areas. The department has also recently begun a process to reform the intervenor process. All of these reforms are likely to continue to attract more insurers and increase competition, which will ultimately benefit consumers.

To get a sense of what mitigation discounts might be most impactful in changing market availability (as opposed to pricing), we looked to see if any mitigation features are specified in the current underwriting criteria disclosed in insurers’ rate filings. Notably, we find that some insurers have indicated a willingness to write more policies in high-risk areas if properties are certified as meeting the IBHS WPH+ standard. For instance, currently Farmers only insurers homes in areas of high fire risk (as measured by zone, slope, and fuels) if they are IBHS WPH+. If you secure a WPH certification (base or plus level), CSAA Insurance Group has committed that your single-family homeowners policy won't be non-renewed due to wildfire risk and they will renew your homeowners policy for a minimum of three years if you maintain the certification and all other requirements of your policy. Mercury noted in its filing that, subject to any concentration restrictions, they would not restrict new business for homes that are IBHS WPH or WPH+ certified. This suggests that insurers might be open to expanding into high-risk areas as long as certain measures can demonstrably change their loss profiles in reliable ways.

For consumers, three key findings emerge from this snapshot of wildfire mitigation discounts in the California market. First, home hardening and defensible space matters for insurability and insurance premiums. Homeowners should seek out information on retrofits to improve the wildfire resilience of their home, especially if they are going to be undertaking any other work or construction on their house. Indeed, incorporating wildfire measures during other construction could be less disruptive and possibly more cost-effective and will improve insurance outcomes. Second, the best chance at insurance availability and improved pricing is by undertaking the full suite of measures in the IBHS WPH certification. Finally, if homeowners do invest in risk reduction, they should share the information with their insurer and also shop their policy, as well.

Notes to appendix table: a - for policies with a FireLine score of 1-3; b - for policies with a FireLine score of 4+; c - for policies with a Zesty Level 1 Group of 1-2; d - for policies with a Zesty Level 1 Group of 3-5; e - for policies with a Zesty Level 1 Group of 6-10; f - Author’s calculation based on the equations provided. g - apply if structure separation <=10 feet; h - apply if structure separation >10 feet and <30 feet; i - apply if structure separation >=30 feet; jk - for homes that do not have IBHS Wildfire Prepared Home designations but have completed a combination of specified home hardening and defensible space improvements; l - includes communities that meet IBHS Wildfire Prepared Neighborhood or similar standards (e.g., communities that effectively remediate connective fuel pathways around and within the community, communities where the structures meet home hardening requirements); m - 16% if both Mercury Wildfire Mitigation Community and Firewise USA Recognition Program, 15.1% if both Mercury Wildfire Mitigation Community and Fire Risk Reduction Community, 16.1% if Mercury Wildfire Mitigation Community, Firewise USA Recognition Program, and Fire Risk Reduction Community; n - for Type 1 and Type 2 non-combustible fire-resistive constructions that meet Mercury’s window, vent, and defensible space requirements; o - apply if in High or Very High Wildfire Hazard Zone.