Understanding residual insurance programs

What is a residual insurance program?

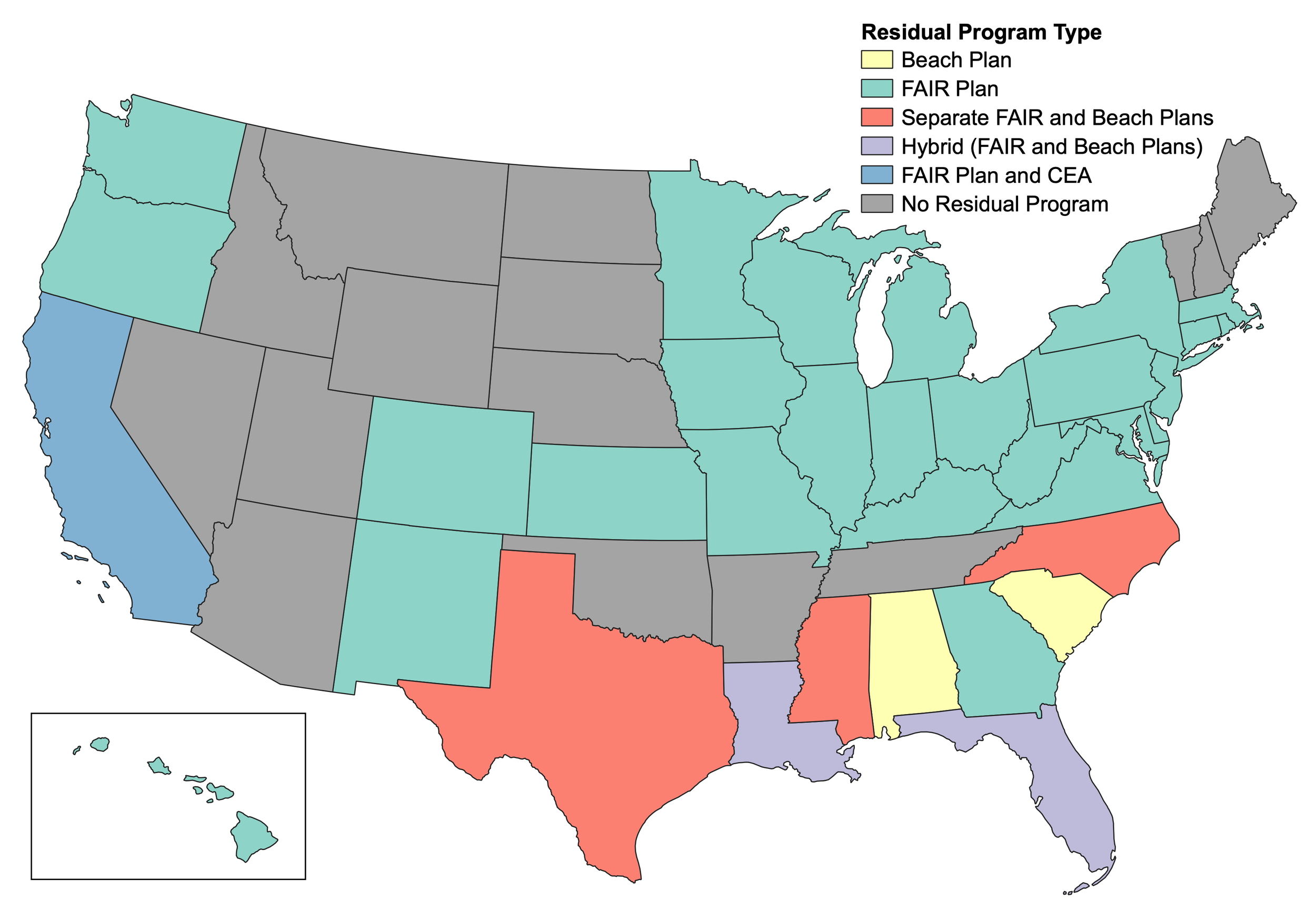

Map created with data from PIPSO and individual program websites. Originally published here.

Many states across the country have residual insurance programs, often called markets of last resort or a public option. These are state-created programs for residents who cannot find or afford insurance coverage in the private market. This includes wind or beach plans, FAIR plans, and hybrid models. It also includes the California Earthquake Authority (CEA), a unique program for earthquake coverage. In total, 39 state-level programs operate in 34 states, plus the District of Columbia.

Understanding the terms.

FAIR PLAN

Federal legislation in 1968 created state FAIR (Fair Access to Insurance Requirements ) plans, which were designed to address a lack of insurance in urban areas due to a combination of civil unrest and exclusionary financing resulting from redlining and other discriminatory practices. The federal legislation provided federally subsidized reinsurance for losses from riots or civil disorder. Some of these programs have since expanded to cover other risks, such as the California program and wildfire.

BeACH PLan or wind POOL

These are state-created insurance programs that provide wind-only or full homeowners coverage in hurricane-prone coastal regions.

Louisiana and Florida have hybrid programs that are a combination of a FAIR and Beach plan.

residual insurance program

A residual insurance program is any government-created program designed to offer insurance for residents who cannot find coverage in the private market. They can vary in structure and operate federally or at a state level. State programs typically operate independently as non-profits. The National Flood Insurance Program, FAIR plans, Beach plans, and hybrid programs are all residual insurance programs.

Overview reports of residual markets.

What is the future of State-Created insurance programs?

-

As the risk of climate-related disasters continues to escalate, property insurance markets in many locations around the United States have been destabilized. As it gets harder for residents in risky areas to find insurance – or find it at a price they can afford – many residents turn to residual insurance markets. In this paper, the authors provide an overview of these programs, current dynamics, and discuss the urgent policy questions as to how the costs of disasters should be distributed and whether these programs still are, or can remain, true markets of last resort.

Market of Last Resort: an overview

-

APCIA conducted an analysis of the changes in the state residual markets, finding that market challenges are worsening in the highest climate-risk regions. But state regulatory regimes are also a driver in determining whether consumers are able to obtain policies from a competitive private insurance market. Some states are limiting private insurance risk-based pricing while subsidizing government residual markets, masking increasing climate risk and effectively subsidizing overdevelopment in high-climate risk areas.

Managing Natural Catastrophe Risk: State Insurance Programs

-

This article surveys state-created programs in the U.S. aimed at providing natural catastrophe insurance to property owners unable to find policies in the private market. The article provides an overview of ten state programs and outlines the motivation for establishing such programs. The implications of design and operation decisions are discussed, as well as how these programs interact with the private property insurance market. Finally, the article examines whether such programs can handle a truly catastrophic loss year and describes proposals for federal support of these programs.

Driving loss reduction.

As climate change increases the frequency and magnitude of natural disasters, private insurers are pulling back in high-risk areas, leading to growing exposure in the state-created insurance programs. This increasing risk also creates growing fiscal challenges for residual markets. Risk reduction investments are necessary to reduce future damages, improve the insurability of properties, and stabilize the fiscal position of residual insurance programs.

This report, by researchers at EDF and Cornell, examines how state residual insurance markets are incorporating risk reduction strategies, identifies best practices, and provides recommendations for programs to enhance their risk reduction initiatives.

The risk reduction approaches currently in use by residual markets include:

Premium discounts for homes that adopt proven risk-reduction measures, such as wind-resistant construction.

No-cost policy endorsements that fund stronger rebuilding after disasters.

Household grants for high-risk homes to retrofit them to more resilient standards.

Upcoming Event:

How State Insurance Programs Can Lower Disaster Losses

In this EDF webinar, hear residual market leaders and experts discuss how state programs across the country can help policyholders reduce their risk and bolster resilience.

November 5: noon - 1pm ET

Panelists:

Gina Hardy, Chief Executive Officer for the North Carolina Joint Underwriting Association (NCJUA) and the North Carolina Insurance Underwriting Association (NCIUA)

Janiele Maffei, Executive Director of the California Residential Mitigation Program at the California Earthquake Authority

Lars Powell, PhD, director and senior research professional, Center for Risk and Insurance Research, The University of Alabama

Carolyn Kousky, PhD, Founder and Executive Director, Insurance for Good

Moderator: Talley Burley, Senior Manager Climate Risk & Insurance, Environmental Defense Fund

How are losses paid for in residual markets?

While created by state action, residual insurance markets are not state agencies and they are not backed by state dollars. Many residual insurance programs rely heavily on post-disaster financing for covering catastrophe losses, spreading costs beyond current policyholders. This is typically done by the program issuing bonds to cover losses and then repaying the debt through post-disaster assessments either on admitted carriers in the state (some of which will then pass the cost through to their policyholders) or directly on policyholders. Typically policyholders across many lines of coverage and across the entire state are subject to assessments and pass-throughs, not just those in the program. The structure of assessments varies somewhat across programs but all result in cross-subsidies, with the cost of a disaster being partially covered by future policyholders and by lower-risk policyholders elsewhere in the state.

State residual programs through time

This second figure shows the policies in force in each program, going back to 2009. Florida, by far the largest, has seen swings over time as policy in the state changed between considering it a market of last resort and a market of first resort.

Data for both figures from PIPSO.

This figure shows exposure (billions of USD) in select state-level programs for the last decade. Florida and California are the largest programs in the country. Florida has recently shrunk somewhat, while California continues to grow.

State resources.

Select state analyses and information.

Alabama

Florida

Louisiana

North Carolina

California

Still have questions about residual insurance programs?

Drop us a note with any questions that were not answered in the above reports and other resources.