Understanding residual insurance programs

Map created with data from PIPSO and individual program websites. Originally published here.

What is a residual insurance program?

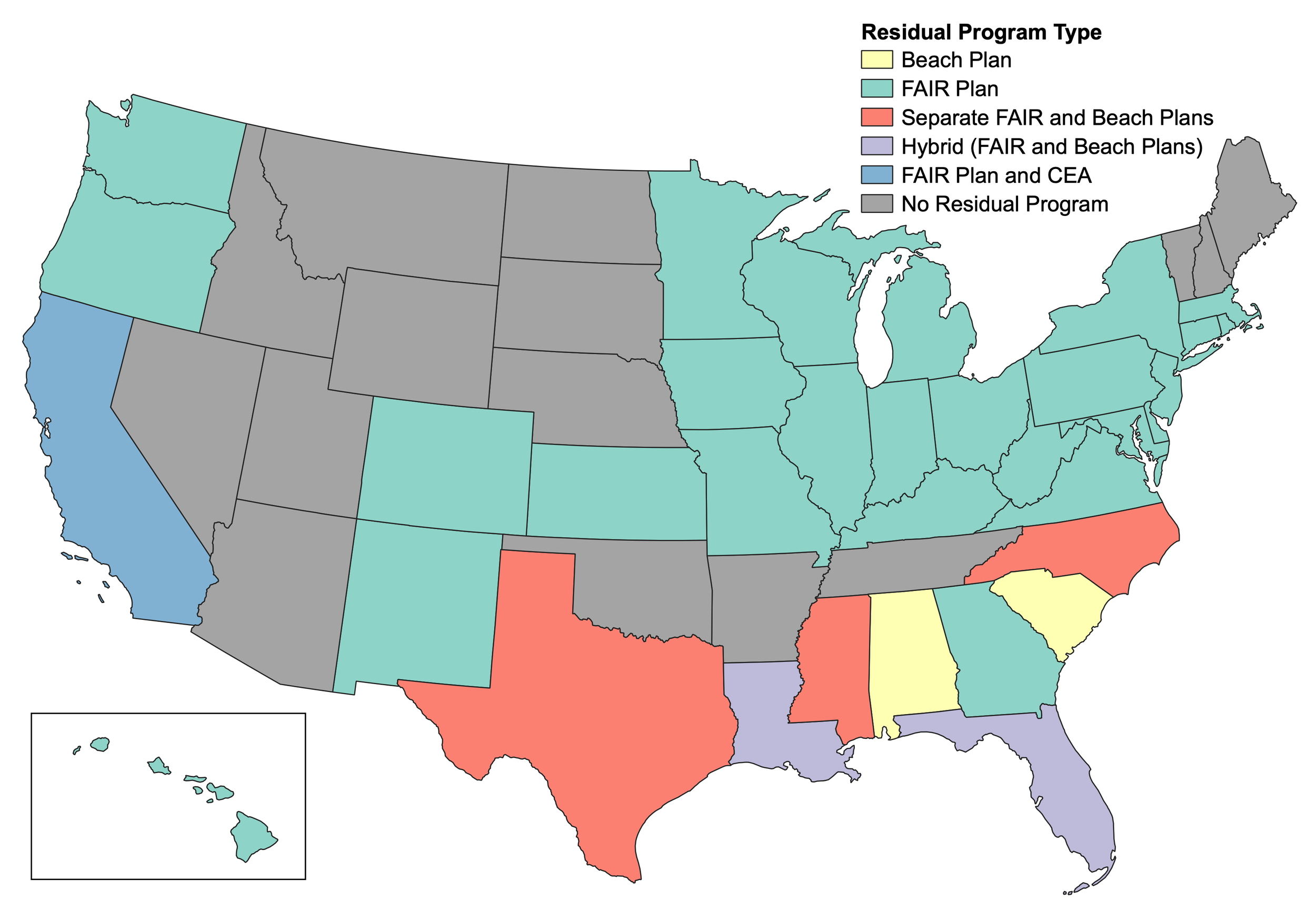

Many states across the country have residual insurance programs, often called “markets of last resort,” which include wind or beach plans, FAIR plans, and other models. It also includes the California Earthquake Authority (CEA). These programs provide insurance to residents who cannot find, or afford, coverage in the private market. In total, 39 unique programmes operate in 34 states, plus the District of Columbia.

Understanding terms.

FAIR PLAN

Federal legislation in 1968 created state FAIR (Fair Access to Insurance Requirements ) plans, which were designed to address a lack of insurance in urban areas due to a combination of civil unrest and exclusionary financing resulting from redlining and other discriminatory practices. The federal legislation provided federally subsidized reinsurance for losses from riots or civil disorder. Many of these programs have since expanded to cover other risks, such as wildfire.

BeACH PLan or wind POOL

These are state-created insurance programs that provide wind-only or full homeowners coverage in hurricane-prone coastal regions.

Louisiana and Florida have hybrid programs that are a combination of a FAIR and Beach plan.

residual insurance program

A residual insurance program is any state-created program designed to be a last-resort option for residents. They vary in structure, but typically operate independently as non-profits.

Learn more.

What is the future of State-Created insurance programs?

-

As the risk of climate-related disasters continues to escalate, property insurance markets in many locations around the United States have been destabilized. As it gets harder for residents in risky areas to find insurance – or find it at a price they can afford, many residents turn to residual insurance markets. In recent years, several of these programs have been expanding. In this paper, the authors provide an overview of these programs, current dynamics, and discuss the urgent policy questions as to how the costs of disasters should be distributed and whether these programs still are, or can remain, true markets of last resort.

Understanding Parametric Insurance

-

The models often discussed to help create more equitable access to risk transfer often harness parametric concepts. Learn what that means here.

Exploring Insurance Innovation in South Carolina

-

The report reveals several common challenges across all programs and sources for economic recovery. it provides an overview of how to use microsinsurance or community insurance to fill gaps in the disaster safety net.